What is a financial planner?

One question I get asked regularly is “what is a financial planner?”

Let’s say you’ve got questions about finances. Which I’m thinking you do, otherwise you wouldn’t be reading this.

Who’s got answers to your financial questions? Friends. Family. And, of course, there’s the internet.

But how do you know what information is correct? Or what information is relevant to your circumstances?

That’s where a financial planner comes in.

So, what does a financial planner do?

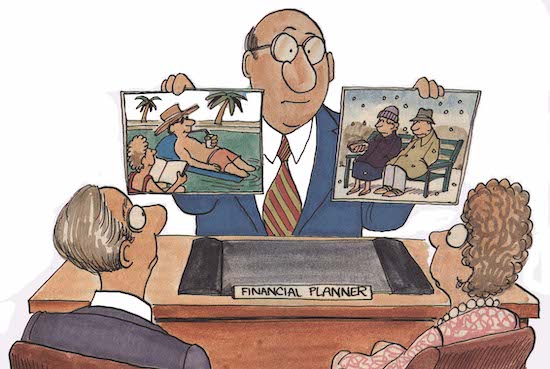

Everybody’s financial circumstances and goals are different, for various reasons. A financial planner helps you understand and reach your financial goals.

Financial planners can analyse your financial circumstances. Then they use their expertise and insights to help you create your financial plan. This plan allows you to reach your goals. This may include:

- strategies for reducing and paying off your debt

- ideal asset allocations for your retirement accounts

- guidance on financial products you should consider using to help realise your goals

The financial planner’s advice process

Here’s a breakdown of the advice process:

- Getting to know you. This is the fact-finding stage, where the financial planner learns more about your circumstances.

- Setting goals and priorities. The financial planner than talks with you about your goals and priorities. If you’re stuck on goal setting, a good financial planner can help you.

- Crunching the numbers. The financial planner will then review, in detail, your financial circumstances. This is necessary planning for the next step.

- Strategy development. This is where a financial planner develops strategies that best fir your circumstances and goals.

- Understand the advice. You’ll then receive advice from your financial planner. This includes advice about the recommended strategy. Depending on your response to that advice, the financial planner will tweak the strategy.

- Make it happen. This is all about implementing the financial planner’s advice and strategy.

- Stay on track. A good financial adviser will help you stay on track. After all, we’re all human and sometimes we need to be held accountable.

Why are financial planners important?

They can help you gain clarity by creating a personalised plan to suit your financial and life goals. Sometimes there are questions you’ll ask that a financial planner can’t answer. But they’ll be able to put you in touch with other qualified professionals who can, such as:

- accountants

- estate planners

- finance brokers

This makes it much easier for you to get all the advice you need.

Do I need a financial planner?

There’s no one-size-fits-all approach to financial planning. And this is because everyone’s circumstances are different. Advice from a financial planner can help most people, but not everyone will need it.

Below are some situations where financial planning advice will help you. This list isn’t, by any means, an exhaustive one:

- Your income changes. This is particularly the case when your income changes dramatically. A financial planner can help you create a new budget and re-evaluate your goals.

- You’re getting married. A financial planner can help you and your future spouse discuss various issues. This may include how to handle existing debt, save for a marital home or plan for having children.

- You’re separating from a spouse or de facto partner. This is a stressful period for many people. And one that requires careful financial planning.

- You’re expecting a newborn child. If you’re expecting or are planning to adopt, a financial planner can help you with life insurance. They can also help you save and budget for your child’s future.

- You receive a significant windfall. This may be in the form of a large bonus from work or an inheritance. A financial planner can work with you to develop a plan for that money to ensure you reach your goals.

Is my financial planner qualified? And what should I look for in a financial planner?

All financial planners must hold or work under an Australian financial services licence as an authorised representative of a licence holder. The Australian Securities and Investments Commission (ASIC) administers these licences.

ASIC requires financial planners to offer a financial services guide before giving advice. This is also known as a FSG. This document should tell you the types of fees you’re paying and how they’re billed. It should be in plain English so that it’s easy to understand. We recommend that you read any FSG you’re given very carefully. And if there’s something you don’t understand, ask about it!

Keen to learn what it’s like to have a financial planner in your corner? Feel free to book in a 15-minute chat and let us help you.

The information provided on this webpage is intended to provide general information only and the information has been prepared without taking into account any particular person’s objectives, financial situation or needs. Before acting on such information, you should consider the appropriateness of the information having regard to your personal objectives, financial situation or needs.

Liked what you read?

Here are some other related insights: