You’ve probably heard of the term ‘compounding interest’. But do you know what it is?

If you’re interested in investing, then understanding what compounding interest is and how it works till help you. A lot.

So, put your learning cap on and get ready to discover the magic of compounding interest – the eighth wonder of the world!

What is compounding interest and how is it different to simple interest?

Compound interest is where you earn interest on:

- the initial deposit you made into your savings account (commonly known as the principal), and

- the interest you’ve already earned

This means that as your investment grows, the interest it earns also increases.

Simple interest works differently. With simple interest, you only earn interest on the principal amount. You don’t earn interest on the interest you’ve already earned.

This means you’re able to earn more money with a compounding interest account.

Why should you start using compounding interest now?

The sooner you start investing, the more time and potential your money has to compound. This means you’ll earn more than if you try to catch up later on.

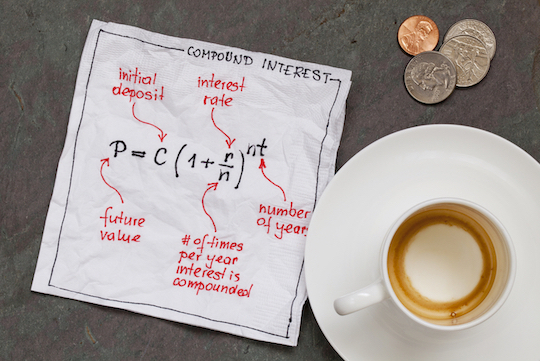

How does compound interest work?

Imagine planting a small seed that grows into a huge tree. It takes time. It’s the same with investing money. Investing a small sum of money today can lead to substantial growth in the future.

For example, let’s say you deposit $10,000 into a savings account that earns 8% interest. In an account with simple interest, your annual interest would be $800 per year, every single year. That means over 20 years, your $10,000 turns into $26,000.

How does that compare with a compounding interest account with an 8% interest rate?

In the first year, it’d earn $800 (just like the simple interest account). But in the second year, you’d be earning 8% on $10,800. But with the simple interest account, you’re still only earning interest on the initial $10,000.

The result? That $10,000 in the compounding interest account would turn into $46,609.57 after 20 years. That’s just over $20,000 difference!

There are many compounding interest calculators out there that you can use to see how your investment would grow.

What’s the role of a financial planner in compounding interest investments?

Investing your hard-earned cash can be an overwhelming process. Why? Because there are so many options out there, that it’s difficult to know what’s best for you.

That’s where a financial planner can help you. A good financial planner guides and educates you to make informed decisions about your future. Including being able to guide you with compound interest investment options.

With the right financial advice, your wealth creation doesn’t need to be hard.

Conclusion

Compounding interest can be a great addition to your wealth creation strategy. It means you get more from your money than using simple interest. But the key is starting to invest as early as possible.

If you’re ready to take your financial freedom journey to the next level, book an obligation-free chat with us today.

Important information: This information is of a general nature and has been prepared without taking into account your particular financial needs, circumstances and objectives. While every effort has been made to ensure the accuracy of the information, it is not guaranteed. You should obtain professional advice before acting on the information contained in this article.