One of the best things about investing early is that it gives your money time to grow. Investing doesn’t have to be intimidating or reserved for financial “experts.” The best time to start investing is as soon as you’re ready (spoiler: that might be right now).

Investment & Wealth Creation Articles

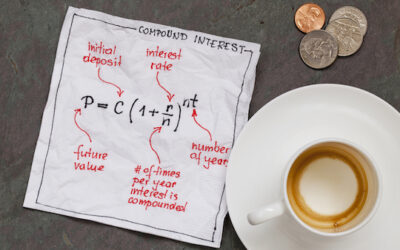

Compounding interest on savings accounts: what is it and how does it work?

You’ve probably heard of the term ‘compounding interest’. But do you know what it is? If you’re interested in investing, then understanding what compounding interest is and how it works till help you. A lot. So, put your learning cap on and get ready to discover the...

SMSF Glossary

Our SMSF Glossary is your go-to guide for unravelling the intricacies of self-managing your super. Whether you’re a seasoned investor or just starting, we’ve got your back.

What You Do Now Determines Your Financial Future

Most working professionals are aware of the importance of goals and their impact on their day-to-day lives. However, some key areas may be overlooked during your goal-setting process. One of the most important areas to set goals in is your financial life. With this in...

Discover Your Money Personality To Achieve Financial Success

Discover your money personality to boost your financial success. Learn about the strengths and challenges of four common money personalities.

7 Financial Planning Tips for Couples

How to manage finances as a couple - without the arguments We’ve been married for a long time - 22 years in fact - so we know discussing financial stuff with your partner is hard. But it just has to be done. Otherwise, it only leads to arguments. According to...

Money and relationships – being open with each other is the key to success

We are pretty sure there isn’t a couple in the world that hasn’t argued over money. Financial stress is one of the leading causes of relationship stress and breakdown and often emerges as an issue in couples counselling, but if you’re willing to be completely honest and patient with each other, it doesn’t have to be that way.

Wealth Creation: It’s not as hard as you might think

You may have been told over the years that it’s important to save for your future. Sometimes that means saving up for a new car, a mortgage deposit or your retirement. But no one can dispute that wealth creation, whether short term or long term, is often put in the ‘too hard’ basket.

How we work

Never worked with a financial advisor and want to learn more about how we work?

Meet the Creo Wealth team

Want to learn more about our team? We’re here to support you throughout your financial freedom journey.

Find us on socials

Kylie is the Yin to Anthony’s Yang.

With a Diploma in Financial Planning, she’s spent over 25 years in the financial services industry, using her knowledge and skills to successfully weave an adoration of style and travel, alongside business, into her life.

While Kylie brings experience and knowledge from brands like ANZ, HSBC, Deutsche Bank and Merrill Lynch, she also brings heart and inspiration to Creo Wealth. This shows in how she manages the Creo Wealth team who feel appreciated by Kylie (oh, and Anthony too!)

But Kylie’s heart and inspiration doesn’t stop there. She’s a huge spender and certifiable shoe addict. This, along with her upbringing, means Kylie truly understands how hard it is to get in touch with your money story.

She’s on a mission to educate people to help them understand their money story. And then give them the tools to begin rewriting it. Kylie loves to use her stylish shoes to kick-start people’s confidence to set and reach their financial goals.

And the fun part for Kylie?

She always looks classy when she challenges Anthony for that last M&M.