Investment Advisors Sydney

Investment advice that makes your money work harder

Did you know that investment planning isn’t just for retirement?

And that investment advice isn’t only for the rich?

We’re financial investment advisors here to tell you that investing if for everyone. You read that right, everyone.

So, whether you’re fresh out of high school or you’ve been around the block a few times, it’s never too soon to start your wealth creation journey. And it’s never too late either.

Whatever your financial goals are, we’re here to help you. From owning your own home to buying an island, we tailor our advice to you. No cookie cutter advice here! And if you’re after a closet full of Jimmy Choo shoes, then you’ll love Kylie, our resident shoe addict. No judgment here!

We get to know you. We find out what level of risk you’re comfortable with. And we listen to you to find out your financial goals and the lifestyle you’re aiming for. Then we put together a financial plan that’s best for you.

Want to know the best part? Financial planning is not as hard as you might think.

With the right financial advice, wealth creation doesn’t need to be hard

While your wealth creation goals will change over time, the one consistency you’ll have is us. We’ll be there for you during every step of your wealth creation journey.

And it’s not about us telling you what to do. We guide and educate you so that you can make informed decisions about your financial future.

How? By helping you:

- take control of your cash

- identify your needs and wants

- set detailed and practical goals

- implement your new financial plan

How easy is that?

But what if I’m living pay cheque to pay cheque?

Or I’ve got surplus funds but can’t seem to get ahead?

We get it. And we’re not just saying that for the hell of it. Kylie’s actually been there. Literally.

With over 20 years’ experience in the business, Anthony and Kylie know that no one size fits all. So our advice is always tailored to you and your circumstances.

It’s not about how much cash you earn

But it’s what you do with it that matters

We don’t expect you to know how to budget, save or invest wisely. It’s all a learning curve. After all, it’s not something we’re taught at school (although that’s where Anthony’s love affair with numbers began).

We understand it feels scary to start your journey to financial freedom. But we’ll educate and guide you every step of the way.

Why? Educating you helps you make informed decisions about your wealth. And guiding you ensures you stay on track to your financial freedom.

If I can go from fielding debt collectors like a pro to living a life that I love, then so can you.

Kylie Sultana

Investment strategies tailored for you

Investing your cash is great for long-term wealth creation. The hard part? Understanding then implementing what’s best for you. But that’s why we’re here.

We like to give you a choice by recommending a range of different strategies. Here’s a taster:

Managed investments

Managed funds are great if you’d like your investment ‘pooled’ and managed by a team of experts, who buy and sell on your behalf. It takes the stress out of investing!

Property investments

Interested in receiving rental income or purchasing property for the future retail value? Then this option might be for you. But there are a number of factors to consider here. And this is where our devotion to numbers and analytics comes into play. Nerdy? For sure, but it’s also awesome!

Superannuation

It’s so easy to take our superannuation for granted. But the reality is our superannuation will define our standard of living when we retire. The time to plan is now. The world of super is complex. But we consider ourselves superheroes of superannuation. Who doesn’t want a superhero on their team?

Personal risk insurances

At Creo Wealth, we’re all about the positives. But we’re also realistic. Because sometimes life doesn’t go as planned. Personal risk insurance protects both you and your loved ones when the unexpected happens. After all, why create financial freedom if you don’t protect it?

Investment Planning FAQ

What is investment planning?

Investment planning is your game plan for hitting your money goals. You pick the investments that make sense for you, sketch out how they’ll help you get where you want to be financially, and keep an eye on risk so you’re not biting off more than you can chew. It’s all about getting your money to work for you in a way that fits your comfort zone and future plans.

- Identifying Goals: Retirement, education, home purchase, etc.

- Risk Assessment: Understanding your risk tolerance based on factors like age, financial status, and future commitments.

- Asset Allocation: Choosing a blend of investments that align with your risk tolerance and objectives.

- Ongoing Review: Regularly tracking performance to ensure you’re on course to meet your goals.

It’s not just about picking stocks; it’s a comprehensive strategy to grow your wealth while managing risks.

Who should consider investment planning?

You don’t have to be rolling in dough to think about investment planning. It’s for everyone who wants to make their money work harder. Whether you’ve got big plans like retiring in style or sending your kids to uni, or you want to build up a nice financial cushion, investment planning can be customised to fit your life and wallet right now.

- Future Security: Ensures long-term financial stability.

- Goal Achievement: Helps you work towards financial goals, whether it’s buying a home or funding education.

- Risk Management: Allows you to make informed decisions that align with your comfort level for financial risks.

You don’t have to be wealthy; you have to be forward-thinking.

What kind of investments are considered?

When it comes to investing, you’ve got a whole menu of options. Think of it like a buffet. On one end, you’ve got the “safe bets” like government bonds. On the other, you’ve got the “thrill rides” like stocks. Your plate could have a bit of everything—stocks, bonds, real estate, even managed funds—all depending on what you’re comfortable with and how long you’re in the game for.

- Low-Risk Investments: Such as government bonds and savings accounts.

- Medium-Risk Investments: Like real estate and certain managed funds.

- High-Risk Investments: Such as stocks, commodities, and cryptocurrency.

Your investment plan should have a diversified mix to balance risk and returns.

What is the goal of investment planning?

What’s the endgame? Simple. You want your money to grow and help you tick off those big life goals—maybe it’s retiring on a beach or putting your kids through school. It’s all about making smart moves to get the most bang for your buck, while not going overboard on the risk factor.

- Wealth Growth: To increase your financial resources over time.

- Goal Realisation: To fund specific life events or objectives, like retirement.

- Financial Security: To ensure you and your family are financially stable, especially during unplanned events.

It’s not just about making money; it’s about strategically allocating it for future benefits.

Do you have to be wealthy to think about investment planning?

Nah, you don’t have to be loaded to start investment planning. It’s all about playing your cards right with whatever you’ve got. Take a look at where you are now, set some doable goals, and go from there. It’s all game, no matter your starting line.

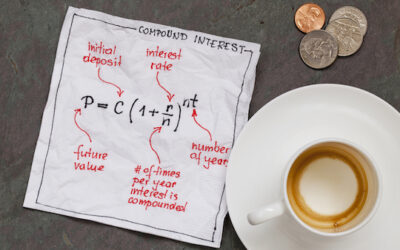

- Resource Allocation: Even a small amount can grow exponentially if invested wisely.

- Financial Literacy: Understanding investment basics can go a long way in improving your financial future.

- Goal-Setting: Setting achievable targets make the planning process much more manageable, no matter your starting point.

Whether you’re starting with $100 or $100,000, the right plan can set you on a path to financial freedom.

Why Creo Wealth?

We’re a family owned business. And we believe that everyone deserves financial freedom, regardless of your background. We’re passionate about educting you and guiding you on your way to financial freedom.

But don’t just take our word for it. Check out some client love from past and current clients.

Our values

Passion

We have a passion for numbers and helping you reduce the fear that comes with managing your finances. The result? You can walk your journey towards financial freedom with more confidence.

Knowledge

Ensuring our team is up to date with relevant knowledge. And spending time to educate you, so you can make informed decisions about your financial future.

Solutions

Presenting you with solutions that best suit your circumstances and your financial goals. No cookie cutter financial planning advice here.

Commitment

We’re committed to helping you discover what financial freedom means for you. And we’re committed to helping you get there.

Integrity

At Creo Wealth, integrity is the name of the game. We’re huge believers in acting honestly and with integrity. After all, you need to work with a financial planner you can trust.

Respect

Financial planning and wealth creation can feel so overwhelming. Which is why we treat our team members and you as our client with respect. After all, we’re all human.

Recent insights about wealth creation

Want to see what’s possible in your financial future?

Let’s have an obligation-free chat. And discover how we can help you creat, grow and protect your wealth.